Introduction

A Guide for 2024 Merchant Cash Advance Providers:

So, you’ve integrated a CRM and started using analytics – a great start, but is it enough for what’s coming in 2024? The bar is constantly rising in the dynamic world of Merchant Cash Advances (MCAs). Are you just keeping pace or prepared to be a front-runner? As we approach 2024, the role of Artificial Intelligence (AI) and advanced analytics in MCAs has evolved from a futuristic idea to an essential tool. Those who have already embraced these technologies are not just coping; they’re thriving, reshaping the landscape. Are you among the trailblazers, or are you on the verge of being left behind?

Are you among the trailblazers, or are you on the verge of being left behind?

1: Beyond pretty charts, embracing advanced Analytics and Machine Learning.

Only a few years ago, moving from spreadsheets to incorporating a Customer Relationship Management (CRM) system or basic analytics tools was considered a significant step forward for MCA providers. This transition, once a cutting-edge move, has now become the standard. Its important to note that we are talking about serious analytics, beyond pretty graphs and beyond just having the information at hand. The importance lies in what do you do with such information.

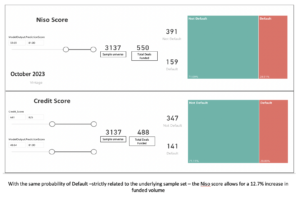

As we move into 2024, the landscape is shifting again. This time, the new standard is the integration of Artificial Intelligence (AI) and Machine Learning (ML). Adopting these technologies is no longer a choice but a necessity for those looking to remain competitive and effective. Furthermore, it’s important to note that the efficiency and precision of these AI and ML systems improve over time. The sooner an MCA provider implements these technologies, the quicker they will differentiate themselves in the market and experience growth. Early adoption means harnessing a continually evolving intelligence, setting a foundation for not just keeping pace but leading in the industry. Utilizing AI and ML can dramatically enhance how MCA providers assess credit risk, understand customer behavior, and make funding decisions. These technologies facilitate a more nuanced and accurate analysis of data.

🔎 Application in MCA Industry: The Power of Advanced Underwriting

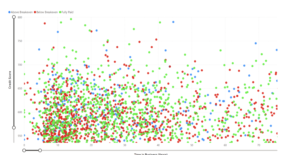

Figure representing distributions of Above and Below breakeven deals across fico score and time in business

The MCA industry, fraught with complexities, demands more than basic metrics for underwriting decisions.

For instance, referring to the figure above, we observe deals both above and below the breakeven point, scattered across various FICO scores and durations of Time in Business. This presents a significant challenge for any Underwriter attempting to gauge success based solely on these factors.

The dilemma involves not only the risk of selecting a range of FICO scores that inadvertently includes poor-performing leads, but also the risk of excluding potential ‘bad apples’ and inadvertently missing out on viable deals. There must be more than Time in Business and FICO scores to navigate this complexity. The issue at hand then is multi-variable and, from a mathematical standpoint, poses a substantial challenge for humans to consider multiple variables and their interrelations concurrently.

Here’s how ML Systems transform this landscape:

🔍 A Deeper Dive into Data: You can delve beyond the surface, uncovering crucial, often-overlooked data that significantly impacts underwriting decisions.

🔄 Continuous Enhancement through Machine Learning: Algorithms are dynamic, constantly evolving and refining, leading to improved underwriting decisions and reduced default rates.

The Risk of Staying Behind: As we approach 2024, Merchant Cash Advance (MCA) providers who do not embrace advanced methodologies may find themselves at a competitive disadvantage. The risk extends beyond the likelihood of increased default rates to a more critical issue: the potential lack of insight into the true profitability of their lending practices.

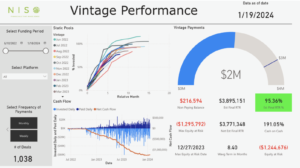

The intricacy of Merchant Cash Advance (MCA) investments and portfolios renders simplistic ‘back of the napkin’ calculations not only inadequate but potentially misleading. Given these financial instruments’ complex, compounding nature, relying on such rudimentary methods can result in significantly erroneous conclusions. It’s essential to employ more sophisticated and accurate analytical approaches to understand and effectively manage these investments fully. The industry is evolving rapidly, and maintaining the status quo is no longer viable.

2: Tackling the MCA Exception Challenge

In an ideal world, systems operate seamlessly under perfect conditions. Yet, the reality is that we don’t live in a utopia, and there are countless exceptions to these ‘standard conditions’ that businesses grapple with daily. This is especially true in the volatile, fast-paced MCA landscape.

Within the Merchant Cash Advance sphere, these exceptions aren’t mere bumps in the road; they’re potential mountainous barriers that could determine the fate of financial opportunities. Fail to handle an exception well, and you’re looking at:

– Lack of Control: Exceptions can lead to unpredictable results, challenging management and oversight.

– Delayed Information: Instead of real-time or timely insights, businesses grapple with postponed reports, affecting decision-making.

– The ‘Good Enough’ Syndrome: Instead of precision, there’s a settling for ‘just about okay’ results, jeopardizing quality and outcomes.

– Operational Costs Surge: As exceptions increase, so does the need for personnel to manage them, inflating operational costs. Instead of manually adding more personnel to manage each exception, Technology can help you overcome those intelligently, saving time, effort, and money.

3: Building Transparency and Trust

Do you know that the number one factor that causes investors and participants to lose trust and move to other players is a lack of communication?

In the highly competitive and fast-paced world of MCAs, transparent and effective communication is not just a nice to have; it’s an absolute necessity for sustaining and growing investor relationships. Reports often present true and accurate information but are hard to decipher for an Investor.

🔎 What should MCAs prioritize to maintain clarity and trust with investors and stakeholders? Time is lost while responding to Investors’ calls, sometimes leading to frustration.

- Comprehensive Reporting: A complete view of investments is essential. It’s not just about the numbers; it’s about the story they tell. Comprehensive reporting provides a holistic view of performance, highlighting achievements and improvement areas.

- Consistent, Data-Driven Insights: Clarity comes from consistency. Regular, data-backed insights offer a clear picture of current performance and future potential, aiding in strategic planning and forecasting.

- Well-Informed Syndicates: When syndicates are kept in the loop with detailed and accurate information, they can make aligned and strategic decisions. This not only fosters trust but also ensures everyone is working towards the same goals.

- Clarity in Presentation: Insights should be presented in a way that is easily understood, eliminating any guesswork. This means using clear visuals, straightforward language, and accessible formats.

- Building Trust: Consistent transparency in reporting fosters more profound relationships with your syndicates. Trust is built when investors feel informed and respected.

- Empowering Decision-Making: Robust data equips your syndicates to make informed investment decisions. They can invest confidently and strategically when they comprehensively understand the situation.

4. Conclusion💡

As we look towards 2024, the MCA industry is set to become more dynamic and competitive. Adopting AI and BI tools is not just a recommendation; it’s a requirement for success. The risk of not adapting is significant – from increased default rates to a lack of understanding of the true profitability of underwriting practices. We at NISO are committed to partnering with MCA funders to navigate this evolving landscape and achieve their strategic objectives.

Ready to see what NISO can do for your MCA business in 2024?

We offer personalized demos, giving you hands-on experience with our cuttingedge solutions.

These demos are tailored to your needs, showing how our AI and analytics tools can transform your operations, increase your volume, and decrease default rates.

To explore the potential impact of our services on your MCA business, please book a demo call for a personalized demonstration. Let us show you how to adapt and excel in the evolving world of MCAs.

https://calendly.com/nisomeet/