Business intelligence (BI) is the technology-driven arrangement that allows businesses to organize, analyze and contextualize information within the company.

BI has become the key to support decision-making. Developing such a system requires knowledge and experience in various fields and proven strategies to support a coordinated, consistent, and curated data flow that starts with transaction-level detail and is transformed to answer specific business challenges.

BI capabilities center on built-in, customizable reports and dashboards for Performance evaluation, What-If scenarios, and, ultimately, decision-making.

But How is BI Used in the Merchant Cash Advance Industry Today?

With the power of BI, firms can use both financial and operational information to gather business insights from current, historical, and future data. This information is used to track financials closely and Key Performance Indicators, optimize their underwriting and operational processes, and make better decisions in almost every organization.

NISO’s Business Intelligence Tool allows the entire MCA organization to make better choices by examining large volumes of data from all business divisions and even from external sources when available.

Benefits of Using NISO’s Business Intelligence (BI) tool for MCA

Using our business intelligence approach is the opposite of working with multiple spreadsheets or relying on basic, one-dimensional reporting. Instead, BI provides a manageable way to correlate and visualize large amounts of diverse data from various sources to reveal financial and operational insights and make them available to anyone in the organization.

Let’s take a look at the potential benefits:

Increased profitability

You can simulate future scenarios and determine the probability of different outcomes using your present transactional data in what-if strategies. When you incorporate your underwriting data points into this analysis, you can test your decision process to make the best determinations for performance.

Better communication

In the MCA industry, daily transactions and multiple data flows are obstacles to good communication.

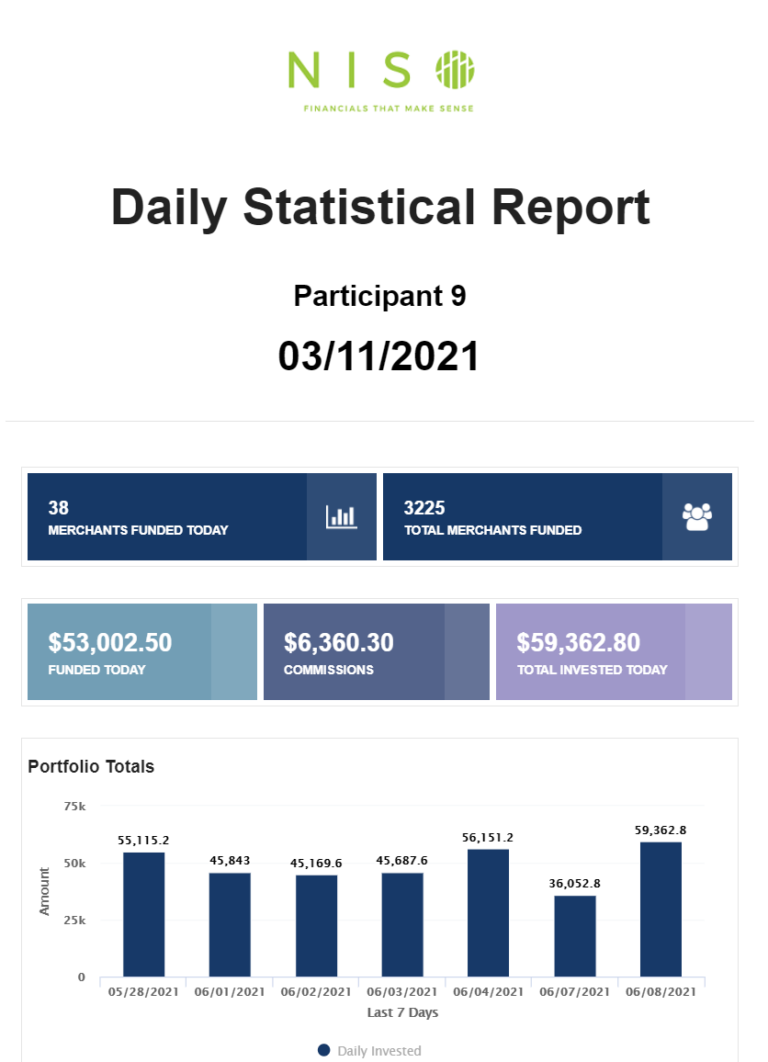

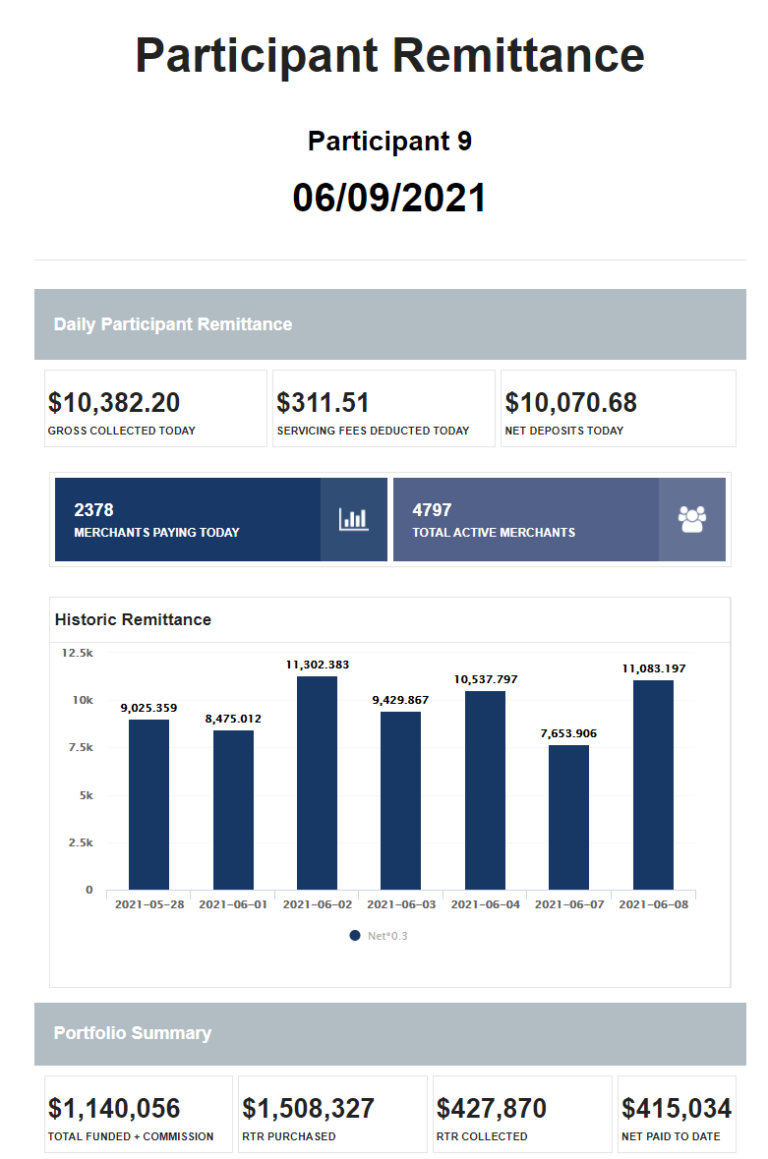

With NISO’s BI tool in place, you can ensure that all participants, ISOs, brokers, and everyone will have the data presented in reports that work for each stakeholder. No more double-checking Excel spreadsheets or waiting for separate data source analysis: you will have a centralized data warehouse with Dissemination of Information to Stakeholders or Interested parties via Daily Reports.

The example below shows how your stakeholders could get information from their deals:

Time Optimization

With BI, you can get real-time information about your financial situation so that you can focus on the commercial efforts needed for your MCA success. In addition, having these reports at hand will let you focus on your MCA core activities.

We offer you the decision-making support you need. But we also provide for multiplatform tracking, complete portfolio visibility w/static pools, metrics, pacing, IRR, Cash Projections, and the necessary bookkeeping in total coherence with the views presented.

You won’t be in the dark anymore!

By implementing the NISO BI engine and reporting capabilities, you can make decisions supported by reliable real-time data.

We have developed an approach to follow performance and analyze what-If scenarios to improve performance and operational procedures. And, most importantly, we work in a coordinated and coherent manner, considering every completely traceable detail from the highest perspective to transaction-level information.

We provide this as a Service, not in the form of off-the-shelf software. We do interact with your own CRM (s) or those that provide information to you. We have a set of usual metrics and dashboard components, but we tailor them to meet your requirements and preferred settings.

Do you want to join a discovery call and see How NISO can help to improve?

NISO is an all-in-one business financial team for Participants, Brokers, and Originators in the MCA industry, supported by the latest technology tools and MCA financial professionals.